Investing is all we do. That’s why, we’re good at it.Invest today in Tax Saving Fund (ELSS - Equity Linked Savings Scheme) with DSP, India's leading asset management company.🆓 ZERO commissions, invest in direct mutual funds💰 Save upto ₹46,800 in tax under Section 80C🤞 Invest lumpsum or start an SIP🌱 Grow wealth with a well diversified portfolio https://bit.ly/DSPTaxSavingFund

Things to know before you invest

- This is an Equity Linked Savings Scheme (ELSS).

- Investing in this fund allows you to avail a tax deduction on up to Rs 1.5 lakh annually under Sec 80C of Income Tax Act 1961.

- It invests in established as well as emerging companies across market caps to provide a combination of growth & stability.

- You can save up to Rs 46,800 by investing up to Rs 1.5 lakh in this fund.

- It also helps you aim to grow your wealth by investing in a mix of large & mid-sized companies, offering growth at reasonable prices.

- Lowest lock-in period of 3 years as compared to other tax saving options under Section 80C.

- Can help you beat the impact of rising prices over the long-term.

- Want to save tax.

- Have the patience & mental resilience to remain invested for a decade or more.

- Recognize market falls as good opportunities to invest even more.

- Accept that equity investing means exposure to risk.

- Do not chase the highest possible returns at all times.

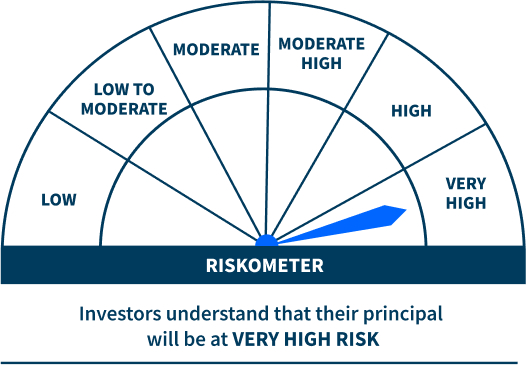

- Tax Saver fund carries Very High Risk.

- There is a lock-in period of 3 years, once you invest.

- Expect short term return fluctuations, especially during periods of market ups & downs.

Historical Returns (As per SEBI format)as of February 28, 2023 with investment of₹10,000

| This fund | NIFTY 500 TRI ^ | NIFTY 50 TRI # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

| 1 Year | 5.16% | ₹ 10,516 | 2.58% | ₹ 10,258 | 4.27% | ₹ 10,427 |

| 3 years | 19.05% | ₹ 16,882 | 17.55% | ₹ 16,249 | 16.98% | ₹ 16,014 |

| 5 Years | 12.9% | ₹ 18,349 | 10.66% | ₹ 16,596 | 11.89% | ₹ 17,540 |

| since Inception | 16.17% | ₹ 45,876 | 12.81% | ₹ 34,053 | 12.44% | ₹ 32,917 |

| NAV / Index Value | ₹ 87.68 | ₹ 22,546 | ₹ 25,184 | |||

Date of allotment: Jan 01, 2013.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Direct Plan.

Since inception returns have been calculated from the date of allotment till February 28, 2023

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

^ Fund Benchmark # Standard Benchmark

- For lumpsum investments, if the investment period is less than 1 year then same return values are displayed for absolute & XIRR. For periods above 1 year, they are annualized. 1 Year is assumed as 365 days.

- Returns for investments in income distribution cum capital withdrawal (IDCW) plans of schemes are calculated after assuming that the net income distribution cum capital withdrawal (IDCW) payouts post statutory taxes & levies, are re-invested back in the scheme.

- Income distribution cum capital withdrawals (IDCW) declared from benchmark's constituents isn't taken into account when comparing with investment in fund's income distribution cum capital withdrawal (IDCW) plans.

- Performance is always compared against the latest benchmark of the fund irrespective of the date of change of fund's benchmark, if any.

- Except when SIP tenure is since inception, for all tenures, the start day for SIP investments is considered as 1st of every month. There is no end date to SIPs for the purpose of graphs.

- For the purpose of NAV date applicability, if the investment date happens to be a non-business day, next business day's NAV is applied. Investment on inception date can happen on a non-business day.

- Gold prices are available post 29 JAN, 2005 & are based on daily closing values on MCX.

- Investment in gold has a strong global market demand and gold is highly liquid asset.

- PPF interest rate is assumed at 8.7% p.a. & interest received is compounded daily for the returns illustration in the charts.

- The comparison with PPF (and other traditional saving instruments/assets) has been given for the purpose of the general information only. Investments in mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike traditional saving instruments there is no capital protection guarantee or assurance of any return in mutual fund investment. Traditional savings instruments are comparatively low risk products and are generally backed by the Government. Investment in mutual funds carries high risk as compared to the traditional saving instruments and any investment decision needs to be taken only after consulting the Tax Consultant or Mutual Fund Distributor.

- Past performance may or may not sustain in future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in any scheme of DSP Mutual Fund.

- The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

- The investment approach / framework/ strategy / portfolio / other data mentioned herein are dated and currently followed by the scheme and the same may change in future depending on market conditions and other factors.

Fund Details

Fund Details

Investment Objective

The primary investment objective of the Scheme is to seek to generate medium to long-term capital appreciation from a diversified portfolio that is substantially constituted of equity and equity related securities of corporates, and to enable investors avail of a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time.

There is no assurance that the investment objective of the Scheme will be realized.

Fund Type

An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit

Riskometer

Level of Risk in the fund

Minimum Investment

Rs. 500 Lumpsum

Rs. 500 SIP– 6 instalments

Rs. 500 Minimum Additional Purchase

Comments

Post a Comment